21. THE TROUBLED 21st CENTURY

MOUNTING DOMESTIC PROBLEMS

CONTENTS

Growing income inequality in America Growing income inequality in America

A culture of greed A culture of greed

The huge American trade imbalance The huge American trade imbalance

The government's own economic The government's own economic

failings

The financial catastrophe of 2008 The financial catastrophe of 2008

Bush's Troubled Assets Relief Program Bush's Troubled Assets Relief Program

(TARP)

Secularism pushes Christianity into Secularism pushes Christianity into

further retreat

The textual material on page below is drawn directly from my work

A Moral History of Western Society © 2024, Volume Two, pages 389-395.

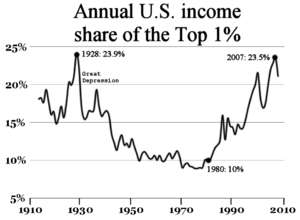

GROWING INCOME INEQUALITY IN AMERICA |

Similar

to the late 1800s, America was beginning to register a huge and

ever-widening gap between the richest and the poorest in America. The

relative income equality of the 1940s, 1950s, and 1960s had – since the

1970s – been changing to one in which a greedy few vastly outdistanced

the economic growth of those of a lower social status.

For instance, in the twenty-five-year period of 1979 to 2004, the

lowest fifth of American income earners had advanced by only 6 percent

… not even close to keeping up with the inflation rate hitting the

country. In short, they had become even poorer. The next fifth advanced

by 17 percent, the middle fifth by 21 percent, and the next highest

fifth by 29 percent … closer to the inflation rate. In short, they had

made no real gains economically – although, even at that, they lived

fairly well. But the top fifth had advanced during that period by 69

percent … and of that group, the top 1 percent had advanced by 176

percent.

Indeed, in a study done by the New York Times, during the year 2005,

the national income figure increased by 9 percent … although that

growth had benefited only the top 10 percent of American income

earners. In fact, the top 1 percent registered a growth of 14 percent.

The lower 90 percent actually registered a slight dip in real wealth.

Worse, the top 0.1 percent of the population (some 300,000 individuals)

made the same total income as the bottom 50 percent or 150 million

Americans. Their incomes were 440 times the average income of that

lower half … twice the disparity that existed in 1980.

Thus, the horrible income spread of the late 1800s, had returned to

America. But unlike the reforming urge of the Teddy Roosevelt and

Howard Taft presidencies at the beginning of the 1900s, no one in

Washington seemed to be willing to do anything about this matter.

Certainly part of this was due to the change in the character of the

American economy itself as it moved from heavy industry to the world of

high-tech industry ... with the low-tech jobs now going "offshore"

(Africa, Asia, Latin America). A high school education typical of the

lower realm of American society no longer serviced the needs of

America's new industrial order. An expensive college education (growing

ever more expensive with each passing year) would be required – putting

a lot of Americans in deep debt just to keep up with the shift in the

working world.

|

Wikipedia – Financial crisis of

2007-2008

In

turn this was causing Americans to lose sight of the need for more

economic discipline – both individually and nationally. Thus Americans

– in order to keep up a fairly fancy lifestyle – found themselves in

mounting debt … especially with the introduction of the charge and

debit cards.

But actually, a culture of greed was impacting even more the

professional world (lawyers, doctors, corporate presidents, etc.) –

where salaries were climbing annually at a rapid rate way beyond any

real improvement in the services they actually provided American

society. They simply were getting very rich … because that was

now considered their "entitlement" … in a society that now tended to

look at every matter not as one of duty or obligation but instead as

one of entitlement.

THE HUGE AMERICAN TRADE IMBALANCE |

Part

of the fancier American lifestyle was that Americans were "helping" the

world's economy by buying more of what foreign manufacturers provided

than what America itself sold to those same people abroad. In short,

America was experiencing a huge and ever-growing deficit in the balance

of trade.

America was able to do this because the dollar was still very strong …

constituting about 60 percent of the world's hard-currency reserves. In

short, America was able to sustain this imbalance in the flow of

material wealth (industrial goods and services) in favor of America …

because of the strength of the dollar.

THE GOVERNMENT'S OWN ECONOMIC FAILINGS |

The

war in Iraq had been very expensive … and had earned America nothing

economically in return. As a result, the war – plus America's growing

love of government programs to compensate for the increasingly hard

economic times many Americans were going through – ran the public debt

way up … doubling the size of that debt during the eight years of the

Bush presidency: from $5 trillion to $10 trillion. True, the figures

describing the country's income had increased – but much of that simply

due to inflation – so that the percentage of that national income owed

by the government only went from 57 percent to 70 percent. But still

that was a real shift in the government's economic position. But in any

case, it meant that in 2008, every tax-paying American now shared about

$60 thousand of that debt ... an impossible figure to sustain (but

which would grow even worse over the coming years!)

Of course, debt means that someone or some institution has extended

some kind of "loan" to the indebted party. Indeed, about half of that

debt was being covered by America's own Social Security Trust Fund …

once a fairly independent source of investment for America's retirees –

but now in the full grip of the American government. Consequently,

there was no longer any real material wealth supporting the Trust Fund

… only government IOUs. Most tragically, it had become simply another

version of the 1920s Ponzi Scheme, where the fund had no real wealth to

distribute to investors … except out of the money coming in from new

investors – which was then distributed to prior participants as fake

"payouts" supposedly coming from the investment program itself (from

earnings from real economic ventures). Indeed, there was actually

nothing there of real substance … except the game itself.

It could be wondered why anyone beyond a government-controlled income

source would ever be interested in purchasing shares of that debt.

True, many Americans continued to buy government bonds … the

traditional way that the government covered its debts (as, for instance

in both World War One and World War Two). But looking at the fact that

the government might actually have to start paying off the federal debt

– had it actually done so, it would have taken all the government

spending that was not already committed to a number of ongoing programs.

Thus the Federal Reserve decided to go in a direction opposite that

which Volcker took when he raised the interest rate to 20 percent –

killing off a lot of American business in the process. Instead, the

Federal Reserve kept dropping the interest rate paid on the debt that

others were holding, to a point where the government was willing to pay

off that debt at a rate less than 1 percent! In short, those who would

want to "invest" their life savings in purchasing the bonds that

originally financed that debt would now find themselves putting their

money in a program that paid itself back at a rate lower than the

annual inflation rate. In short, they would be throwing their money

away in purchasing government bonds.

So why then was it that China and Japan chose to continue to fill the

role of financier behind the American debt, each country coming to hold

about 20 percent of that debt? Unsurprisingly, this was not exactly

done out of a spirit of kindness … but for simple economic reasons.

Americans were key purchasers of the industrial production of both

countries … and any American economic retreat would have damaged

greatly their own industries. Besides, for China, holding such economic

leverage over America played well in its growing interest in replacing

America as the world's major superpower.

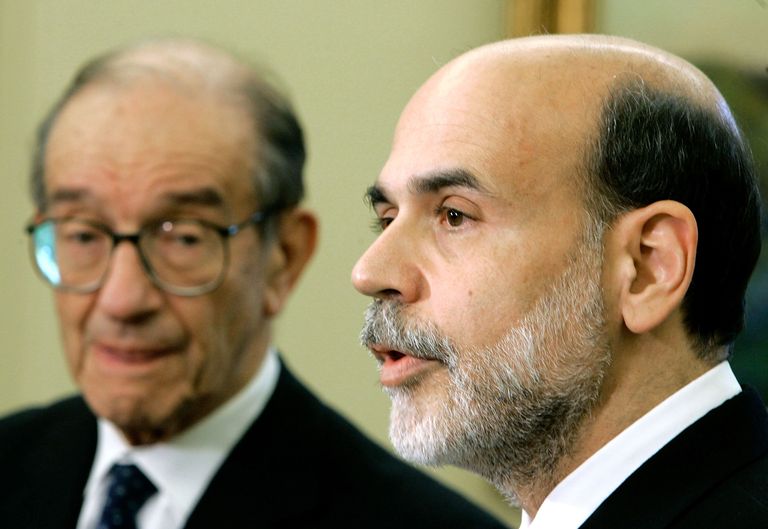

|

Former long-time Federal Reserve

chairman Alan Greenspan ... and replacement nominee, Ben Bernanke

(2005)

THE FINANCIAL CATASTROPHE OF 2008 |

But

ultimately it was this culture of greed at home in America that nearly

toppled the American economy in the last days of the Bush II

Administration. It had to do with the huge American housing market. The

debt-addicted American world found that the home-construction industry

was not keeping up with a growing demand of debt-consumed Americans

(huge college loans, for instance) to move anyway on the American dream

of home ownership. But there was also a bit of urgency driving this

dream … as the price of housing had virtually doubled in the recent

years and thus panicked purchasers felt that it was necessary to take

on the home-owning challenge before the housing market got even worse

for them.

No one is able to purchase an expensive home on the basis of a cash

payment … but instead is going to have to enlist the services of a bank

willing to extend to a purchaser a loan (mortgage) – usually 30 years

in duration as a payback matter – to cover the cost of the home. Of

course banks are supposedly not stupid … and are supposed to look

closely at the financial situation of a potential mortgage purchaser –

to make certain that the purchaser is in the position economically to

repay that loan on a steady basis.

But at this point, the financial world seemed more interested in

running up its business numbers (a matter of corporate prestige) than

going at the matter with its traditional wisdom. A big part of this was

that mortgage banks would have found their businesses slowing up

greatly – because a serious consideration of the financial position of

these already over-extended debtors would have lost them a lot of

business. Relatively speaking it was harder and harder to find

customers not already fully loaded up with debt – hardly in a position

to take on more.

Thus these huge banking organizations began to extend "subprime"

mortgages to "subprime" purchasers … a very foolish thing to do. But at

first this all seemed to go very well. Banks found themselves in

business running at high speed.

Then the bottom fell out of the dreamy enterprise. Contractors raced to

get into the highly lucrative housing market … producing a housing boom

of enormous magnitude. In fact the building boom was so great that soon

recently-constructed houses were sitting there waiting for a purchaser.

Some got sold, many did not. So, the contractors did what the market

demanded: they lowered the prices of their finished home – until (like

the oil market of the early 1980s) they found themselves in competition

to corner the market with ever-lower-priced homes.

But recent mortgage buyers were now finding that their mortgages were

running at a higher rate than the cost of new housing – inviting many

of them to sell in order to purchase a cheaper home. But this merely

put even more houses on the over-saturated housing market. Many

therefore simply "bankrupted" themselves to get out of the mortgage

obligation altogether.

Now the banks found themselves in trouble as panic hit the mortgage

industry. And Wall Street was watching events closely, quickly losing

confidence in a number of major banking corporations … and began to

sell, sell, sell. At this point the two largest mortgage companies

Fannie Mae (the Federal National Mortgage Association) and Freddie Mac

(the Federal Home Loan Mortgage Corporation) - not really federally

owned companies, but federally backed – found themselves facing

bankruptcy (their stock had lost 90 percent of its value by August of

2008). But so too were the huge mortgage corporations Bear Stearns and

Lehman Brothers. Ultimately, Congress decided to bail out Fannie Mae

and Freddie Mac ($100 billion of taxpayers' money) … slowing up – but

not stopping completely – the panic. The huge financial firm J.P.

Morgan was able to buy and thus save Bear Stearns … but Lehman Brothers

could find no backing and simply collapsed. Likewise, Washington

Mutual, America's largest savings and loan bank also collapsed. And

America's largest insurance company, AIG (American International Group)

nearly did so … its stock dropping from $70 a share down to $1.25 a

share. It was saved only when the Federal Reserve stepped in and

offered AIG an $85 billion bailout – increased the following year of

Obama's first year in the White House to $180 billion. In short, the

U.S. government found itself owning 80 percent of this huge insurance

company. And AIG would then have to start selling off its subsidiaries

in order to begin repayment of that huge debt.

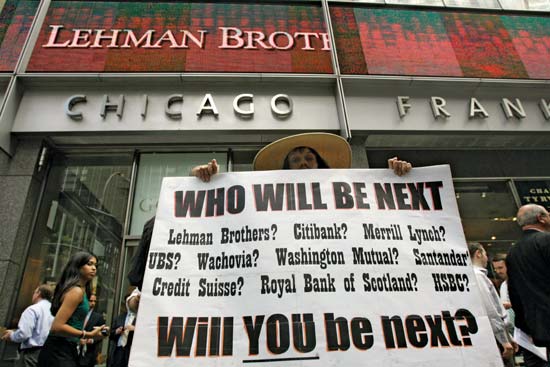

|

2006 – Housing prices begin to drop for

the first time in eleven years

People are now hard pressed to find buyers for the houses they

cannot continue to afford

A protest in front of the Lehman

Brothers headquarters in New York

Lehman Brothers CEO

Richard Fuld heckled by protesters upon leaving Capitol Hill – October

2008

BUSH'S TROUBLED ASSETS RELIEF PROGRAM (TARP) |

Indeed,

Bush took economic control, getting Congress to authorize a $700

billion TARP (Troubled Assets Relief Program) to purchase parts or the

whole of troubled American financial corporations … in order to calm

the Wall Street panic that was ripping American corporations apart.

But even at that, now the American automobile industry found itself in

the same panic mode. Not only were houses now sitting unsold, so were

cars facing the same problem: people were too frightened to take up a

car loan. Thus the American "Big Three" (Ford, General Motors and

Chrysler) were finding themselves in deep trouble at the same time as

the housing market. In 2008, although the production capacity of the

Big Three was 17 million cars a year, that year they produced only 10

million cars – a drop in their production rate by 45 percent of what it

had been in 2007. Thus the labor force had to be cut back, worsening

the unemployment picture … and the solvency of the Big Three themselves

unable to come even close to meeting their operational costs. Here too,

Congress had to step in to save these major American corporations from

total destruction – even though both General Motors and Chrysler were

forced to declare bankruptcy … in order to begin some kind of a

rebuilding program.

|

| September 29, 2008 – Treasury

Secretary Hank Paulson (with Federal Reserve chief Bernanke at his side) begs Congress to authorize the

$700 billion corporate bail-out package (the "Paulson Plan"). Congress's first answer

was a "no" ... which immediately plunged the Dow 778

points – the worst single-day loss in the history of the New York's Wall Street stock

market (at that point).

|

|

Bankers (who were literally forced to take

the government bailout) appearing before Congress – February 2009: CEOs Lloyd Blankfein (Goldman

Sachs), Jamie Dimon (JP Morgan Chase), Robert Kelly (Bank of New York Mellon),

Vikram Pandit (Citigroup), John Stumpf (Wells Fargo). Other banks targeted

for the Government's $125 billion stock purchase of their' preferred stock were State Street,

Bank of America, Merrill Lynch, and Morgan Stanley

|

Another car dealer having to go out of

business

SECULARISM PUSHES CHRISTIANITY INTO FURTHER RETREAT |

Middle

America was also finding itself facing a huge loss in another area of

its traditional social world: the federal courts forcing an even deeper

retreat of America from its Christian social-cultural legacy … actively

substituting Secularism as America's moral-spiritual underpinning. The

Boomers were now the leaders of the adult world and – with the help of

the ACLU – as dedicated as ever to seeing the Christian cultural roots

of their parents (and, for that matter, nearly all Americans before

them) dug up and replaced by fully Secular social-moral foundations.

One particular individual would bring case after case to court – trying

through different challenges to erase the Christian legacy from the

public scene. Most notable was his Newdow v. U.S. Congress

(2000-2004) case in which he tried to get the "under God" portion

removed from the U.S. Pledge of Allegiance. He got a bit ahead of

himself and, though he got the ever-Liberal 9th Circuit Court (covering

Hawaii and the American West) to support him, he failed when the case

advanced to the Supreme Court … though he would bring more cases to

court in pressing forward (2005-2010).

Things proved to be more successful for the American Left when the ACLU jumped into a case, Kitzmiller v. Dover Area School District

(2005) when parents were outraged that a paragraph had been issued by

the school board of Dover, Pennsylvania, to teachers to be read at the

beginning of the 2004 school year – stating that students might want to

explore the book Of Pandas and People

… as a way of discovering that there were other explanations of

Evolution than Darwin's. District Court Judge John Jones helped

determine the outcome of the hearings by the way he called (or didn't

call) specific individuals to speak on the matter. Thus not only did

the decision go against the school board about this paragraph, Jones

imposed a $1 million fine on the school board for "the breathtaking

inanity of the Board's decision" (Jones' own words). Jones (and the

ACLU) made it clear that "science" not "religion" were the only matters

to involve themselves in the education of America's youth. The

impoverished (and soon outvoted) Board carried the matter no further

forward. Jones's decision thus stood as a ruling across the country.

But also, he didn't get the Supreme Court appointment that he seemed to

be angling for.

Once again, the federal courts were telling Americans what it was – and

was not – that they were to rest their worldview, their faith in life,

on. Such matters were to be purely Material or Secular. Christianity,

the worldview that had carried America forward through countless

generations, was now forbidden in America's public life, especially in

the training of rising American generations ... thanks to the ACLU –

and those clever lawyers in black robes.

|

Newdow speaking at the Atheist Alliance International Convention

in Long Beach, California, 2008

Judge John Jones III

The reaction

of Time Magazine

The TV program NOVA

Go on to the next section: Meanwhile the World Has Its Own Issues

Miles

H. Hodges Miles

H. Hodges

| | |

Growing income inequality in America

Growing income inequality in America

The huge American trade imbalance

The huge American trade imbalance

The government's own economic

The government's own economic The financial catastrophe of 2008

The financial catastrophe of 2008

Bush's Troubled Assets Relief Program

Bush's Troubled Assets Relief Program Secularism pushes Christianity into

Secularism pushes Christianity into